Jan 23 2026 01:00

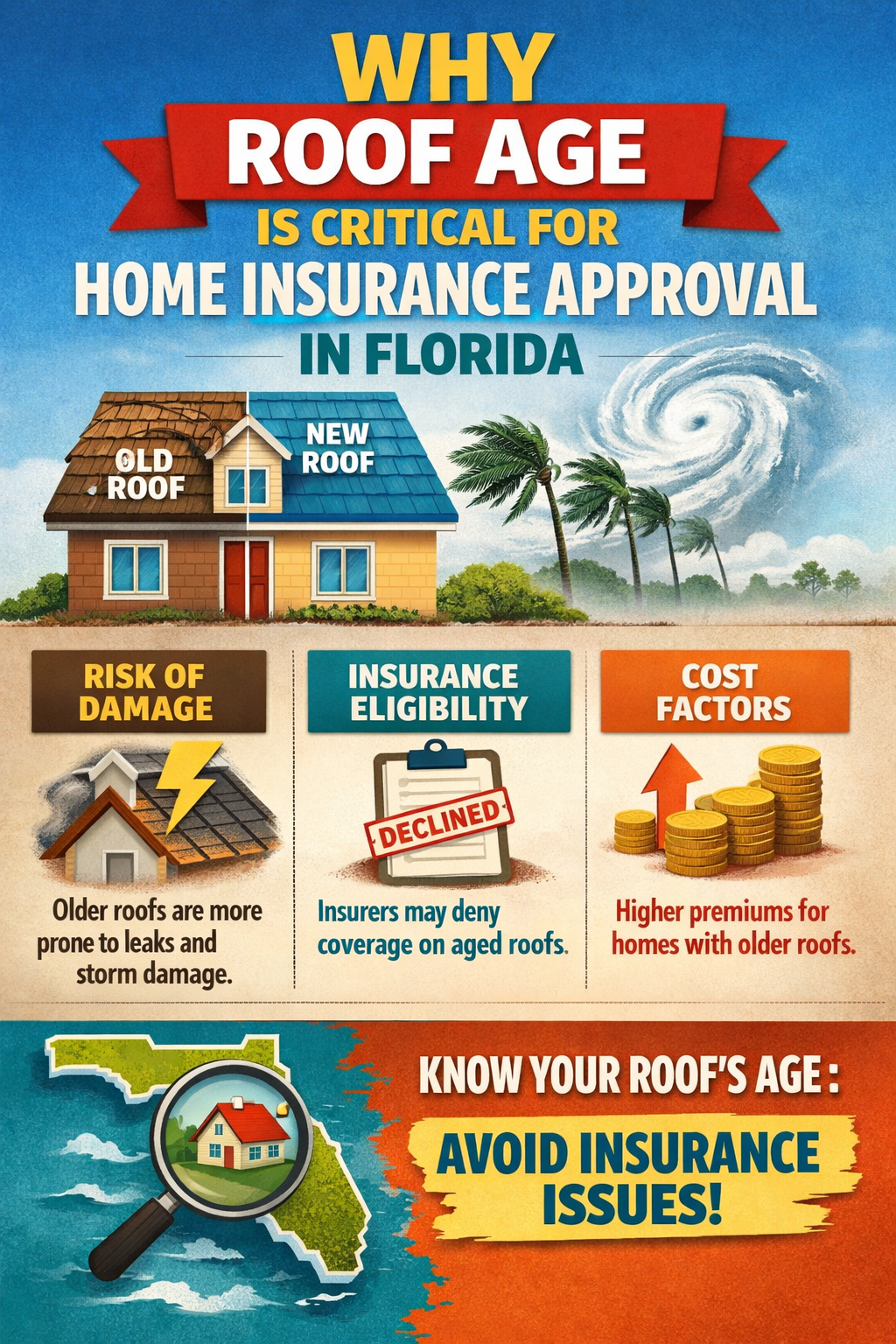

Why Roof Age Is Critical for Home Insurance Approval in Florida

If you’re a Florida homeowner shopping for insurance, one of the first questions you’ll be asked is: How old is your roof? In Florida’s insurance market, roof age plays a major role in home insurance approval, pricing, and coverage options.

Understanding why roof age matters can help you avoid policy cancellations, coverage denials, or unexpected premium increases.

Why Florida Insurance Companies Care About Roof Age

Florida’s climate exposes roofs to extreme conditions, including:

- Hurricanes and tropical storms

- Heavy rain and humidity

- Intense sun and heat

Older roofs are statistically more likely to fail during severe weather, leading to costly claims. Because of this risk, insurance carriers closely evaluate roof age when issuing or renewing homeowners insurance policies in Florida.

Common Roof Age Requirements in Florida

Most Florida insurance companies have strict guidelines based on roof type:

- Shingle roofs:

Typically must be 10–15 years old or newer

- Tile roofs: Often allowed up to 20–25 years, depending on condition

- Metal roofs: May be approved up to 30–40 years if properly maintained

Even if a roof looks fine, carriers may require replacement based solely on age.

How Roof Age Affects Insurance Approval and Cost

An older roof can result in:

- Denial of a new homeowners insurance policy

- Non-renewal of an existing policy

- Higher premiums or limited coverage

- Exclusion of wind or roof coverage

In some cases, insurers may offer actual cash value (ACV)

instead of full replacement cost, significantly reducing claim payouts.

Inspections and Roof Certifications

Insurance companies often require:

- A 4-point inspection

- A roof certification verifying remaining useful life

These reports help carriers determine whether your roof qualifies for coverage. Missing or outdated documentation can delay approval or lead to rejection.

What Florida Homeowners Can Do

If your roof is aging, you still have options:

- Obtain a roof certification from a licensed inspector

- Consider partial or full roof replacement

- Shop carriers that specialize in older roofs

- Review your policy annually to avoid non-renewal surprises

Working with an independent insurance agency can help you navigate these requirements.

Get a Free Florida Home Insurance Quote

At Michaels Insurance Group Inc., we help Florida homeowners find insurance solutions—even with older roofs. Our team understands carrier guidelines and works to secure the best coverage available for your situation.

📞 (631) 629-2233

📞 (386) 274-8150

Call today for a free quote or policy review

and make sure your home insurance coverage isn’t at risk due to roof age.